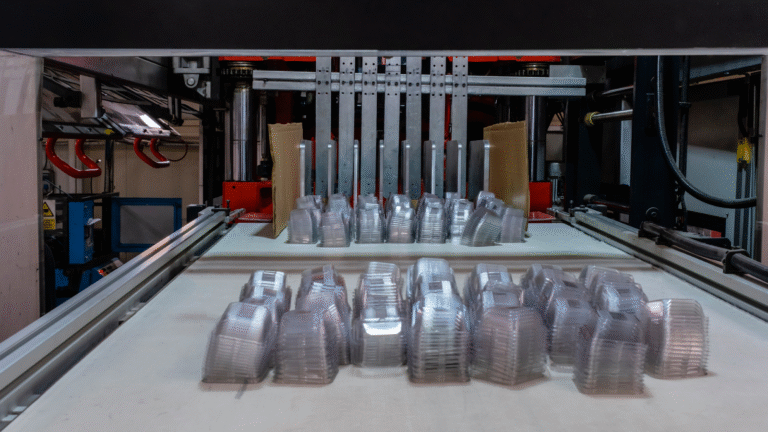

Thermoforming has become a reliable and cost-efficient way to produce custom plastic parts across many industries. By heating and shaping plastic sheets with precise molds, it delivers durable, lightweight components without the high tooling costs or long lead times of injection molding. The process supports flexible designs, quick prototypes, and scalable production, making it a strong option for companies needing custom solutions on a budget.

Why Thermoforming Beats Injection Molding in 2025

Aluminum tooling costs have fallen about 40% since 2023 due to CNC automation and AI-assisted mold design, while steel tooling for injection molding has risen around 25%. This shift makes thermoforming tooling, typically $2,000–$15,000, far more economical than injection molding’s $15,000–$150,000+ range.

Thermoforming remains cost-effective for runs under 50,000 units, and newer high-speed systems in 2025 have pushed that break-even point closer to 100,000 units. This is especially useful for projects with evolving designs or moderate volumes.

AI tools like Moldex3D 2025 and Fusion 360 now optimize mold features in under 48 hours, significantly reducing engineering time.

A medical device company in Ohio applied these advantages, cutting per-unit costs by 55% and reducing lead times from 14 weeks to 3 weeks after shifting to pressure-formed thermoforming.

Breaking Free from Minimum Order Quantity Traps

Traditional plastics manufacturing often requires minimum orders of 5,000, 10,000, or even 25,000 units—an impractical model for product testing, seasonal demand, or niche markets. Capital gets locked into inventory that may never sell, and any design adjustment leaves you with obsolete stock.

The 2025 shift toward on-demand production changed this landscape. Regional manufacturers introduced flexible platforms, and networks such as Xometry’s expanded thermoforming capabilities and Protolabs’ vacuum forming service now accept runs as small as 25–100 units with 5–7 day turnaround times. Per-unit costs may be 40–80% higher than large-volume pricing, but these small-batch workflows help companies avoid inventory risk while still accessing reliable Thermoforming plastic solutions.

Rapid tool changeover systems—often under 15 minutes—now make short production runs economically viable. Facilities manage both high- and low-volume jobs by time-blocking machine schedules. Digital twins and simulation tools further streamline development by eliminating up to 90% of physical prototyping cycles.

For orders below 500 units, desktop thermoforming systems like the Mayku FormBox Pro or local makerspaces using Belovac machines allow design validation for $50–$200 per iteration. For 500–5,000 units, regional thermoformers offering gang tooling make production more cost-efficient by placing multiple part cavities on one sheet, spreading setup costs across several components. Family molds can form 2–4 size variations simultaneously for only about 20% more than separate molds.

A bridge-tooling strategy also helps manage uncertainty. Companies can begin with aluminum tooling—suitable for 10,000–50,000 cycles—and upgrade to hardened steel only if demand grows, avoiding large upfront investments for unproven products.

Materials Nobody Talks About

Most guides list PET, PP, and ABS—cool, but they’re ignoring the material revolution happening right now. Bio-based PET with 30-100% plant content from sources like Eastman Cristal Renew and NatureWorks Ingeo PLA blends are now thermoformable with standard equipment. They deliver a 40% lower carbon footprint with chemically identical performance to virgin PET.

Conductive thermoformable sheets for EMI/RFI shielding (like RTP Company’s 380 Series) work for electronics enclosures that block electromagnetic interference. Antimicrobial-embedded plastics with built-in silver ion or copper additives (PolyOne’s Stat-Tech line) stay effective for the product’s lifetime and meet FDA compliance for medical and food applications.

Bio-based materials cost 15-25% more than virgin petroleum plastics in 2025 (down from 40% in 2023). PCR blends are now cost-neutral or 5-10% cheaper than virgin in most regions due to extended producer responsibility credits. Specialty materials run 50-300% premiums but unlock functionality impossible with other processes.

Request material data sheets for tensile strength, impact resistance, and chemical compatibility—don’t assume PET is PET. Test with accelerated aging protocols (UV exposure, thermal cycling) before committing to production because thermoformed plastics can behave differently than extruded or molded versions. Ask your thermoformer about co-extrusion options: multi-layer sheets with different materials (like barrier layers sandwiched between structural layers) for food packaging needing oxygen and moisture protection.

Hidden Costs That Kill Your Margins

Thermoforming looks cheap on paper, but then secondary costs ambush you. Trimming, scrap rates, finishing, and logistics add up fast if you’re not careful. Manual trimming costs $0.15-$0.45 per part with inconsistent quality. Five-axis CNC routers drop that to $0.03-$0.08 per part with perfect repeatability, but you’re looking at $150,000-$400,000 equipment investment.

Collaborative robot trimming cells (Universal Robots UR10e with vision systems) now cost $45,000-$75,000 and handle 80% of trimming tasks. ROI hits in 8-14 months for mid-volume producers. Laser trimming (CO2 or fiber lasers) offers zero-contact, no tool wear at $0.02-$0.05 per part operating cost. Compact systems under $100,000 became available in 2025.

For low-volume custom work, negotiate as-trimmed pricing that includes finishing at a per-unit cost to avoid surprises. For high-volume runs, request scrap rate guarantees in contracts—the industry standard is 2-5% material waste. Anything above 6% means poor process control. Specify tolerances realistically because ±0.020″ is standard for thermoforming. Tighter tolerances exponentially increase costs.

Skeleton (trim scrap) from thermoforming runs 20-40% of the sheet typically, but it’s 100% regrindable. Partner with thermoformers that have in-house granulation and extrusion to close the loop. They buy virgin sheet, regrind their own scrap, extrude new sheet with PCR content, and the costs drop 12-18%.

Speed Wins Markets

Your competitor just launched, your trade show is in 9 weeks, or your client needs samples yesterday. This is where thermoforming becomes your superpower. Design finalization takes 3-7 days with modern CAD collaboration tools like Onshape and Fusion 360 cloud. Soft tooling (3D-printed or composite molds) needs 5-10 days and works for 50-500 parts, depending on the material.

Aluminum tooling (CNC machined) takes 2-4 weeks standard or 7-10 days expedited. First article samples arrive 1-3 days after tool completion. Production ramp-up happens immediately to 3 days, depending on material sourcing. Total timeline: 3-6 weeks from concept to finished parts in hand versus 12-20 weeks for injection molding.

AI-powered DFM (design for manufacturing) analysis platforms like 3DXpert, Frustum, and aPriori’s 2025 thermoforming module give automated feedback on draft angles, undercuts, and wall thickness in under 5 minutes. Leading thermoformers offer client dashboards showing tool build progress, quality checks, and production photos (like Protolabs’ ProjectHub).

Front-load engineering by paying for 2-4 hours of thermoformer engineering consult ($150-$300 per hour) before finalizing design. It catches 90% of costly mistakes. Specify first article inspection (FAI) in quotes—dimensional reports and photos before full production runs cost $200-$500 but prevent 10,000-unit disasters.

| Manufacturing Method | Tooling Cost | Lead Time | Minimum Order |

| Thermoforming | $2,000-$15,000 | 3-6 weeks | 25-500 units |

| Injection Molding | $15,000-$150,000 | 12-20 weeks | 5,000-10,000 units |

| CNC Machining | $0 | 1-2 weeks | 1-50 units |

When Thermoforming Fails

Look, thermoforming isn’t perfect for everything. Very high production volumes (500,000+ annually) with stable design favor injection molding because per-unit costs drop below thermoforming around 100,000-500,000 units, depending on part size. Complex geometries with undercuts, threads, or enclosed cavities don’t work—thermoforming is limited to draw shapes accessible from one side.

Extremely tight tolerances (±0.005″ or tighter) exceed thermoforming accuracy due to material springback and thermal expansion. Very thick walls (over 0.5″ or 12mm) cause uneven heating and difficult forming. Rigid engineering plastics like PEEK and Ultem don’t thermoform well at all due to high forming temperatures and poor melt flow.

If your part needs threaded inserts, hybrid approaches work. Thermoform the body, then heat-stake or ultrasonically weld metal inserts afterward. If volumes scale beyond 100,000 units, design tooling with injection molding in mind from day one. Use thermoforming as bridge production while injection molds are being built (takes 12-16 weeks).

Run side-by-side quotes at 5,000, 25,000, 100,000, and 500,000 unit volumes to identify the crossover point where injection molding becomes cheaper. Ask “What would make this part easier or cheaper to thermoform?” Often, small design tweaks (adding draft, removing undercuts) unlock huge savings.

Questions About Thermoforming Custom Solutions

What’s realistic for minimum orders in 2025?

It depends on tooling costs versus per-unit price. Traditional thermoformers push 1,000-5,000 minimums, but on-demand platforms now accept 25-500 units with 3-7 day turnaround at 40-80% higher per-unit costs. Invest in aluminum tooling ($3,000-$8,000) you own, then order batches as you sell.

Should I own the mold or let manufacturers keep it?

Always negotiate tool ownership in writing. Some manufacturers bake tooling into per-unit pricing and retain ownership (you’re locked in forever). Pay for tooling separately and get a signed tool ownership agreement plus physical possession when not in production.

Can thermoformed packaging meet FDA food-contact requirements?

Absolutely. The base resin must be FDA-approved for food contact (21 CFR 177.1630 for PP, 21 CFR 177.1315 for PET). Your thermoformer should provide letters of compliance from their sheet supplier. The process must use food-safe release agents.