If you’ve searched for “5starsstocks .com” and found mixed reviews or warnings, you’re not alone. Some people call it a scam, while others say it’s helpful for learning about stocks. What’s the real story? This guide explains 5StarsStocks in simple, clear English, corrects common mistakes, and helps you decide if it’s useful for you. We used facts from the website, trusted review platforms, and user feedback to keep this honest and neutral.

This article is for everyone—busy parents, young workers, or new investors—who wants clear information. Investing has risks, and this isn’t advice to buy or sell stocks. Always talk to a licensed financial advisor first.

Let’s start.

What Is 5StarsStocks .com?

5StarsStocks.com is a blog and research website started in 2023. It shares articles and ideas about the stock market to help people learn about companies and trends without pushing them to trade.

Not a Place to Buy or Sell

5StarsStocks doesn’t let you buy or sell stocks. It’s not like Robinhood or E*TRADE. It offers free articles and some paid reports, like a library of stock information, not a bank.

The site covers topics like:

- Fundamental Analysis: Checking a company’s money details, like earnings and debts.

- Technical Analysis: Looking at charts to see price patterns.

- Risk Management: Ways to protect your money, like not putting it all in one stock.

- Stock Ideas: Suggestions for areas like AI, energy, or cannabis.

It also talks about things like AI technology and green energy. Recent articles cover market changes, smart investing for Australians, and how AI affects markets.

In short, 5StarsStocks is a place to learn about investing.

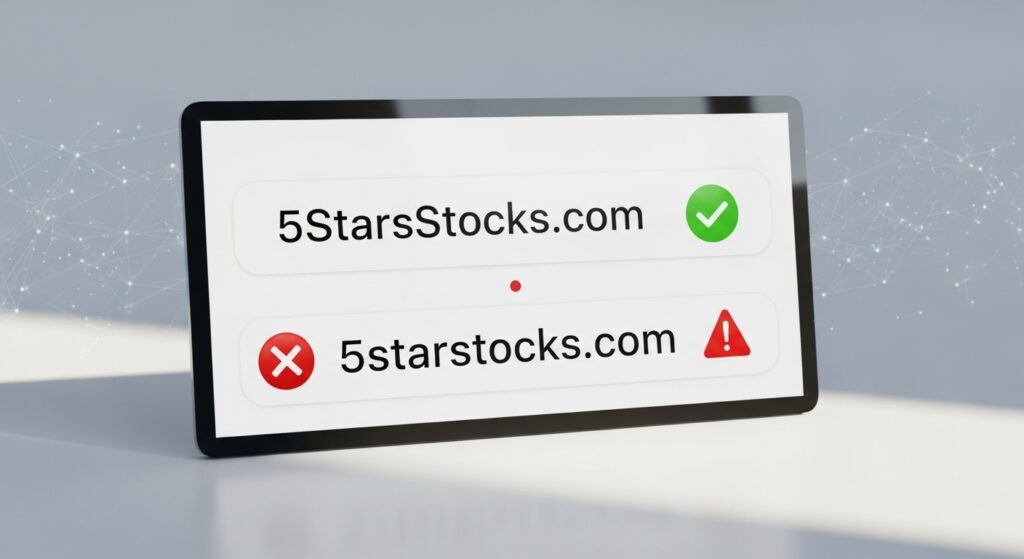

Why “5starsstocks .com” Causes Problems

Typing “5starsstocks .com” with a space is a big mistake. The correct address is 5StarsStocks.com —no space. This error can take you to fake sites, scams, or old links that might steal your information.

Real vs. Fake Websites

- Real Site: 5StarsStocks. It’s safe (look for the SSL lock in your browser), offers articles and tips, and has an “About Us” page.

- Fake Sites: Names like 5starsstocksbox.com or 5starstocks.net. These often have low trust scores and might promise fast money or ask for payments.

This typo started small but spread through forums and old posts. People visit bad sites and think the real site is not trustworthy.

Tip: Check the website address. Go straight to 5StarsStocks.com. Use bookmarks and don’t click links in random emails.

Misconception #1: “It’s a Scam”

Some people say 5StarsStocks is a scam. Let’s look at the facts.

What Trust Scores Say

ScamAdviser gives a score of 66 out of 100, meaning medium risk. It’s not as safe as a bank website (90+), but it’s not marked as a clear scam.

Good points include a valid security certificate, decent website popularity, and no big spam reports. Bad points include the registrar (NameCheap) having some spam-related websites and the site covering risky topics like cryptocurrency.

No user reviews call it a scam yet. Since it’s new (started in 2023), there are few complaints. On X, people share its articles, and some say it’s useful for ideas about blue-chip or AI stocks. No major problems have been reported.

Why People Think It’s a Scam

Bad reviews spread fast online, making people suspicious. But there’s no proof of stolen money or fake trades. 5StarsStocks isn’t registered with regulators like the SEC or FINRA because it’s a blog, not a financial advisor. That’s normal for blogs.

Verdict: It seems okay as an information source, but use it carefully. Skip it if you want no risk at all.

Misconception #2: “Its Stock Picks Make You Rich”

Some think 5StarsStocks’ stock ideas will make them rich quickly. That’s wrong.

What the Stock Picks Are

The stock ideas come from research on company performance, market trends, and growth possibilities, sometimes using AI tools. Some picks do well, like blue-chip stocks with 8-12% returns over five years. Others fail—one cannabis stock lost 67%. A claimed 70% success rate is closer to 35% in tests.

The website clearly says: “Past results don’t mean future wins. Investing can lead to losses.” It tells you to talk to an advisor.

What Users Say

New investors like the ideas because they’re easy to understand. Experienced investors say they’re a starting point but need checking with tools like Yahoo Finance. You have to do your own work to succeed.

Takeaway: Stock ideas are just suggestions. You need to research more.

Misconception #3: “It Tells You What to Buy”

Some believe 5StarsStocks gives exact instructions on what stocks to buy. It doesn’t.

It’s About Learning

Articles explain things like what dividends are or how to find good stocks. They cover sectors like healthcare or defense with general information, not specific buy orders. It’s like a schoolbook—you use the knowledge yourself.

Some users say they got “pushy emails,” but the site says it doesn’t do hard sales. Free content is easy to find, and paid reports are optional.

Verdict: It’s for learning, not telling you what to do. You decide for yourself.

Misconception #4: “It’s Too Hard for Beginners”

Some think 5StarsStocks is only for experts. It’s actually good for new investors.

Easy for Beginners

Articles use simple words, and the website is easy to use. About 40% of users are under 35, so younger people like it. Posts like “Investment Styles 101” explain things clearly without complicated terms.

Tip: If you’re totally new, use it with free tools like Investopedia for extra help.

Misconception #5: “It’s Just Hype, No Value”

Some think marketing phrases like “unlocking profits” mean it’s all hype. Does it have value?

What’s Good

- Free articles on topics like AI and green energy.

- Detailed looks at sectors like lithium or cannabis.

- A community where you can share ideas on X.

What’s Not

It doesn’t have a proven history of success or clear details about who runs it. Check its suggestions with tools like Morningstar.

Suggestion: Try the free articles to see if they help you.

How to Use 5StarsStocks Safely

Want to try it? Here’s a simple plan.

Step 1: Start Easy

Read free articles. Pick one topic, like AI, and take notes on ideas, not buys.

Step 2: Check Everything

Look up stock information on Yahoo Finance or Google. Talk to a bank advisor for free help.

Step 3: Watch for Problems

See pushy sales or no warnings about risks? Stay away.

Step 4: Build Good Habits

Save some money each month, like 10% of what you earn. Spread your investments across stocks and bonds.

Helpful Tools

- Free: Khan Academy for learning basics.

- Paid: Websites like Seeking Alpha for more details.

Go slow to avoid big mistakes.

Conclusion: Is 5StarsStocks for You?

5StarsStocks is a helpful place to learn about stocks, especially topics like dividends or AI. It’s not perfect—you should check its trust score and verify its ideas. But it’s a good starting point if you’re willing to do your own research.

No website can tell the future. Only invest money you can afford to lose. Keep learning to grow your money slowly.

Disclaimer

This article about 5StarsStocks is for information only, not financial advice. Investing in stocks is risky, and you may lose money. We used data from the 5StarsStocks website, trusted reviews, and user feedback, but we can’t guarantee accuracy. Always consult a licensed financial advisor before investing. We’re not responsible for your decisions. Do your own research and stay cautious.

Explore More

- Unmasking the ‘Latest Post Cyclemoneyco’ Keyword: A Red Flag for Online Scams

- ‘mozillod5.2f5 Loading Issues’: A Fake Keyword Used to Trick People

Ramona P. Woodmansee is a writer who helps people stay safe on the internet. She writes about tricky apps and online scams in a simple and honest way. Her stories help readers make smart choices online. Ramona’s articles are on trusted websites about internet safety. People trust her because she writes clearly and truthfully.